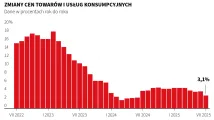

Poland's CPI below 3 pct at end-2025, persitent inflation in services limits scope for rate cuts (opinion)

Inflation trends indicate that Poland's the Consumer Price Index (CPI) will fall below 3 percent at the end of the year, but attention is drawn to the persistently high cost of services, which will limit the scope for interest rate cuts by the Monetary Policy Council, economists assessedfollowing the release of full inflation data for July by Poland's stats office GUS.

As experts at Millennium lender pointed out, the full detailed CPI data for July has shown that Poland's core inflation continues to be driven by persistent inflation in service prices. Last month's core inflation stood at 6.2 percent year on year, down from 6.3 percent in June.

"It is worth noting that in services related to recreation, sports and education, price growth exceeds 8.0 percent year on year. Service price inflation has ‘stuck’ at around 6.0 percent. We attribute this to the continued high wage growth, which, in conditions of solid demand, translates into prices offered to consumer," they pointed out in an e-mail.

The economists continued that, according to their forecast, CPI inflation in the coming months will be similar to the July reading.

"We assume that at the end of the year, the CPI will be 3.3 percent year on year. The prospect of CPI remaining within the acceptable deviations from the inflation target, in our opinion, provides room for interest rate cuts," they assessed, assuming the 25-basis points cut as early as next month.

"This is all the more likely given that the CPI index for August (to be published on August 29) will most likely show a further slight decline. By the end of the year, the reference rate will, according to our forecast, be lowered by a total of 50 basis points, i.e. from the current level of 5.00 percent to 4.50 percent," Millennium experts added.

As they emphasised, their forecast means that there is not much room for lowering the cost of money, given the persistence of service price inflation and expectations of solid economic growth and improved labour demand, which should materialise in 2026.

"Any protective measures in the area of electricity prices after the third quarter of 2025 are unlikely to modify the scenario for Poland's interest rates," they concluded.

Adam Antoniak, the economist at ING BSK lender, also pointed out in an e-mail that Poland's service price inflation remains persistently high, which corresponds to the slowdown in wage growth throughout this year.

"The inflation outlook for the coming weeks remains favourable and, assuming further stabilisation of energy prices, inflation should be close to the Poland's central bank NBP target of 2.5 percent year on year (+/- 1 percentage point)," he assessed.

"Therefore, we expect the Monetary Policy Council to cut interest rates by 25 basis points at its next meeting. We also expect similar decisions in October and November," Antoniak added, sharing the forecasts of Millennium analysts quoted above.

The analysts at Pekao lender stressed on X that core inflation has surprised negatively with an upward trend and this trend seem to contunue.

"We still remember from the preliminary reading that core inflation surprised us with an upward trend. From the details provided today, we learned that this was mainly due to increases in housing costs (water, waste disposal, sewage, etc.). Unfortunately, this is not the end: in the coming months, there will be increases in heating prices after the tariffs are unfrozen," they assessed.

mBank analysts pointed out that there has been a widely expected return to the range of fluctuations around the inflation target.

"In our opinion, core inflation rose to 3.5 percent," they wrote on X.

"Looking at the details, it can be seen that core inflation was slightly boosted by an increase in radio and television licence fees (one-off). However, the entire services section is growing briskly by 1 percent month on month, and the situation is being saved by goods (barely +0.1 percent)," they added.

The experts assessed that considering the information related to water and heating price increases that have taken place (or will take place) since July/August, this element is still missing from inflation and will probably show up in the next reading.

"However, this will not prevent inflation from falling below 3 percent at the end of the year," they concluded.

"(...) The decline in annual inflation is primarily due to the expiry of the base effect related to the partial unfreezing of energy prices in July 2024," PKO BP analysts wrote on X.

According to their estimates, Poland's core inflation fell in July to 3.3 percent y/y from 3.4 percent in the previouus month.

Poland's stats office GUS' final reading confirmed a decline in CPI inflation in July to 3.1 percent year on year from 4.1 percent year on year in June.

tus/ ao/ nl/