Profil:

KGHM Polska Miedź SAPoland’s copper tax changes to support KGHM investments

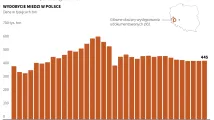

Planned changes to Poland’s copper tax will back listed copper group KGHM investment plans and help lower extraction costs, KGHM said in a press release. The government aims to reduce the tax from 2026, with a budget cost of PLN 500 million (EUR 117.8 mln) that year rising to PLN 750 million (EUR 176.7 mln) in 2027 and 2028 each.

KGHM has long called for changes to copper taxes, therefore it has welcomed the announced changes with enthusiasm.

The group said in a press release that the proposed so-called copper tax reform will enable necessary investments for the group's long-term development and improve operational stability in mining, processing, and metallurgy.

"We face an ambitious task to best utilise the opportunities from the announced tax change. We want to quickly start essential investments in domestic production assets to ensure KGHM’s stable and safe operation for decades," said CEO Andrzej Szydlo, quoted in the press release.

The tax change involves lowering the mining tax coefficient from 0.85 to 0.71 in 2026 and to 0.64 in 2027 and 2028. From 2029, a mechanism will allow deducting 50 percent of qualifying investment expenses from the tax, including costs incurred from 2026. Unused monthly deductions cannot exceed 40 percent of the calculated tax.

In the press release, KGHM highlighted its ongoing investments, including over PLN 3.8 billion (EUR 895.3 mln) planned for 2025, focused on the Main Process Line (the key production process, which includes all stages from the extraction of copper ore to the smelting of concentrate in the smelter), such as new shafts and modernisation projects.

pel/ nl/ ao/