Poland's MPC adjusts interest rates due to CPI outlook, lower wage growth, weaker GDP

In the opinion of Poland's Monetary Policy Council, the decision to adjust the level of Poland's central bank NBP interest rates was justified in view of incoming data, including lower current and forecast inflation, declining wage growth and weaker economic activity data, the MPC said a statement following its decision-making meeting held on May 6-7.

"Given the incoming information, including lower current and forecast inflation, declining wage growth and weaker economic activity data, in the Council's assessment it has become justified to adjust the level of Poland's central bank NBP's interest rates," the MPC stated.

"Further decisions of the Council will depend on incoming information on the outlook for inflation and economic activity," it added.

According to the MPC, the development of demand pressures and the situation on the labour market in the coming quarters, the level of administered prices of energy carriers and further fiscal policy actions all remain factors of uncertainty .

The development of global inflation, including due to changes in the trade policies of the major economies, is also a source of uncertainty.

"Poland's central bank NBP will continue to take all necessary measures to ensure macroeconomic and financial stability, including, above all, a sustainable return of inflation to the NBP's inflation target in the medium term," the MPC and NBP wrote in the official statement published on c. bank's website.

The MPC reiterated the wording from previous announcements that Poland's central bank NBP may intervene in the foreign exchange market.

Taking into account the preliminary data of Poland's stats office GUS on inflation in April (4.2 percent year on year), Poland's central bank NBP estimates that inflation excluding food and energy prices also declined in the previous month, with the growth rate of service prices still elevated.

"The earlier increase in administered prices of energy carriers, as well as the still elevated annual growth of food and non-alcoholic beverages prices translate into a still-elevated level of CPI inflation," it was added.

In the MPC's view, wage growth is still at a high level, but data from the corporate sector signal a decline in this dynamics.

Regarding economic activity in Poland, in the MPC's assessment, the available data signal that the annual growth of economic activity in the first quarter of 2025 was probably below expectations and slightly lower than in the fourth quarter of last year.

"In March this year, the annual growth of retail sales and construction and assembly production were negative, while industrial production increased on an annual basis," they wrote.

"In the labour market, unemployment remains low and employment numbers high, although employment in the business sector in March 2025 was lower than a year earlier," they added.

Assessing the situation abroad, the MPC reported that in the euro area, annual GDP growth in the first quarter of 2025, similar to that in the fourth quarter of 2024, was 1.2 percent, and in the United States, economic activity declined in the first quarter of 2025.

"In both economies, inflation is running close to the central banks' inflation targets. The outlook for global activity and inflation is fraught with uncertainty, including in relation to changes in trade policy," it added.

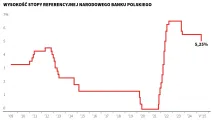

At its meeting held on May 6-7, Poland's Monetary Policy Council has decided to cut all Poland's central bank NBP's interest rates by 50 basis points, including the reference rate to 5.25 percent, in line with market expectations.

From October 2023 to April 2025, the MPC had kept the reference rate at 5.75 percent.

Poland's central bank NBP governor Adam Glapinski will hold a press conference on Thursday, May 8, at 15:00 local time.

tus/ han/ ao/