Poland's MPC adjusts interest rates in October due to improved CPI outlook

Taking into account an improved inflation outlook for the coming period, Poland's Monetary Policy Council assessed that it became justified to adjust the level of the central bank NBP interest rates, the MPC said in the press release following the decision-making meeting held on October 7-8.

"Taking into account an improved inflation outlook for the coming period, in the Council’s assessment, it became justified to adjust the level of the NBP interest rates," the MPC stated.

Following the previous interest rate cut in September (also by 25 basis points), which the Monetary Policy Council consistently refers to as 'adjustments', the MPC stated that it was made in view of "inflation developments".

In October, the MPC has reiterated that its further decisions will depend on incoming information regarding prospects for inflation and economic activity, and that the National Bank of Poland (NBP) may intervene in the foreign exchange market.

As in the previous month, the Council pointed out that fiscal policy, consumption demand recovery and elevated wage growth remain risk factors for low inflation.

"Uncertainty stems also from the level of administered energy prices and inflation developments abroad, following, among others, from changes in trade policies of major economies," the MPC wrote.

It added that the NBP will continue to take all necessary actions in order to ensure macroeconomic and financial stability, including above all to keep inflation at the level consistent with the NBP inflation target in the medium term.

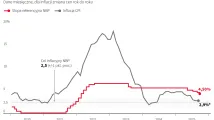

According to the flash estimate by Poland's stats office GUS, annual CPI inflation in September 2025 amounted to 2.9 percent (flat monthly).

"Considering the data mentioned, it can be estimated that inflation net of food and energy prices remained close to the level recorded in August, amidst still elevated services price growth," Poland's Monetary Policy Council assessed.

It added that August 2025 saw a rise in retail sales and industrial output in annual terms,

while construction and assembly production decreased.

"At the same time – despite a slight decline – annual wage growth in the national economy in the second quarter of 2025 remained elevated," the MPC pointed out, noting that data on the enterprise sector indicate a gradual slowdown in the wage growth.

On Wednesday, October 8, the Monetary Policy Council cut all NBP interest rates by 25 basis points, including the reference rate to 4.50 percent. This was the fourth rate cut this year since May, following previous adjustments totalling 100 basis points (by 50 basis points in May and by 25 basis points in July and September).

tus/ ao/